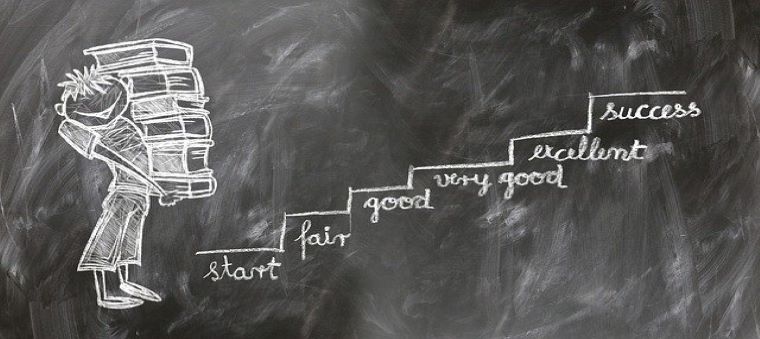

If you've been wondering about how to set your child up for financial success to prevent them from boomeranging home after they leave the nest, you need to read this.

Kids don't do what they are told.

Kids do what they see and what we let them participate in daily.

This shapes their character and is their foundational point of reference after they leave home to make it on their own.

What tools do they have in their bag when they set out on their adulthood adventure?

Multi-millionaire T. Harv Eker has earned a stellar reputation, and dare we say bank balance, over 3 decades in business, helping individuals and companies achieve unfathomable success.

As the Author of bestselling books like Secrets of the Millionaire Mind, SpeedWealth, and Real Self Made Millionaire, he knows his stuff.

Does he sound like a good example to model?

Harv says that he instilled powerful millionaire money habits in his own children from a very early age, and this secured the freedom and independence they enjoy today.

He also believes that it’s never too late to learn how to do the same.

When you hear the term 'boomerang kids', what do you see in your mind's eye?

Let's explore what Harv describes it as...

It’s the sad reality of scores of young adults leaving for college or initial employment, just to return home (hence “boomerang”) when they’ve depleted their finances.

Statistics in 2019 found that only around 24% of young adults are financially independent from their parents by the age of 22.

It was also highlighted, during the same period, that the sum total of U.S. student debt increased by 107% in just one decade.

And it’s becoming worse, says Harv.

Most kids have no idea what to do with money by the time they enter college or the workforce.

Are you wondering why?

Because “Personal Finance” is not a subject that is taught in high school or in college, that’s why!

The youth are expected to make life-changing decisions around money but most were never taught even just the basics, he adds.

This is shocking — but there is a solution.

Harv says that you CAN school your kids on how to manage money effectively in preparation for the financial demands they will face once they leave home.

Ready to prime your child for financial independence in adulthood and practically guarantee them financial freedom?

Then let’s do this!

Here are Harv’s millionaire expert tips on personal finance for kids to help your child cultivate financially successful habits that will prepare them for a happy and responsible adulthood:

As a responsible parent, you’d love to give your kids everything, particularly if it will help their future financial success.

Although it may feel counterintuitive, Harv asserts that teaching them some vital principles and stepping back to grant them space to learn while they’re safe, is a surefire way to instill financial freedom.

Consider if you will…

There’s more to learning how to drive than shifting and pushing pedals, right?

While your kid’s learning how to get from park to reverse, you won’t unleash them into traffic conditions, correct?

Unless you’re in the seat next to them, Harv posits that they will never gain enough safe experience on the road.

The same applies to finances and money.

Your kids need experience in how to handle money before entering the dog-eat-dog adult world, he adds.

Unless you’re ok with letting them crash on the freeway of credit card debt and succumb in a mudslide of student loans on their first financial “driving” adventure, let them experience taking the wheel sooner while you can still show them how.

To be clear, Harv cautions that just like you won’t let your teenager drive your Lamborghini, don’t let them manage your money.

As they’re learning to handle their own financial pressures, you can be their guide.

While they’re still young, Harv emphasizes that you can help keep them from making costly mistakes by teaching them money management in a fun way.

Practice runs with small amounts from either their allowances or their age-appropriate part-time job will cultivate confidence & responsibility for when they need it later, he says.

Everybody would like to be financially free, although Harv asserts that so few individuals understand that in order to be free, you DON’T have to be rich.

He therefore insists that kids MUST grasp this concept.

Your goal to become rich does not guarantee financial freedom, says Harv.

These are two completely different ingredients…

If freedom is the cake, being rich is the frosting.

It takes far less time, effort, and money to focus on gaining your financial freedom than it takes to become rich.

Teach your offspring that the way to become financially free is different to how they will become rich, Harv insists.

They must be mindful of the end game.

They’re not growing up and getting rich so they can be free.

They must become free in order to savor the benefits of riches, he adds.

My definition of financial freedom is simple: It is the ability to live the lifestyle you desire without having to work or rely on anyone else for money. -T. Harv Eker

The most helpful thing you can do to secure your children’s financial success, according to Harv, is to encourage them to make their own money.

They will then understand concepts around people skills and marketing from young.

They’re also less likely to waste valuable time on learning lessons later in life, he adds.

Employment will teach your kids time management while they learn to balance chores, work, and school without dropping back.

Procrastination results in postponement of success and by helping your kids crush the urge that will cause setbacks, Harv recommends that you teach them to fill their time with things that will help them get ahead in life.

Having a job will teach your child invaluable money habits. -T. Harv Eker

Now that your fledgling has a nominal income, Harv insists that they must learn how to manage it.

Once their income is devoted to a specific purpose, grant your child the opportunity to spend it.

They can’t experience financial responsibility if their money is just sitting pretty.

You may think that teaching your kids how to spend money is self-explanatory, but think again.

It takes practice to learn the millionaire art of spending money.

Sometimes, you spend a little more than what you can actually afford because you failed to plan ahead, or you might list a “want” as a “need” in your jar.

A budget helps you to avoid this and if you benefit from it, so will your kid.

You can encourage them to pay for their clothing or let them buy some extras they’d like to have.

It doesn’t matter what they’re responsible for buying.

The lesson is that they learn to plan ahead, ensuring they have enough to buy what they need.

When they’re in the habit of effectively saving and favorably spending from early on, your kids will be financially well-enabled as adults.

Saving money will teach your kids to plan ahead (and wait patiently) for what they want.

Harv’s proven 6 JARS method is superbly successful in teaching kids (and adults) the habits required to save money and to spend it mindfully, practically, and purposefully - let’s elaborate...

Courtesy infographic from Harv Eker International

Here’s an analysis of Harv’s infographic to help you teach your child to be an effective money manager with the income they generate, negotiate, or discover:

Kid’s Jar 1 = 55% for Needs

Kid’s Jar 2 = 10% for Play

Kid’s Jar 3 = 10% for Savings

Kid’s Jar 4 = 5% for Sharing

Kid’s Jar 5 = 10% for Dreams

Kid’s Jar 6 = 10% for Financial Freedom

Harv firmly believes that it is never too early to provide our kids with good examples that will help them maintain a successful mindset that will serve them for the rest of their lives.

And he insists that the habits we help them cultivate will mean the difference between financial success and failure.

Although the road to financial freedom is paved with savings, Harv says you’re not taking optimal advantage of its potential unless you invest part of what you save.

He suggests that you share your own portfolio with your kids and better yet, help them identify good investment opportunities of their own.

It’s never too early to start investing. -T. Harv Eker

Realize that when you start investing, it could make a major difference in your income, therefore consider helping your child start their own portfolio...

Don’t be concerned about their small income, he adds.

You don’t need a lot of money to start investing.

As you guide them toward investment options, Harv asserts that you can help them understand the stock market isn’t their only alternative.

Despite what’s taught in high school economics, there are numerous other ways to earn a passive income.

Once you show them how to get started, Harv recommends that you let them control their investments on their own.

Be available to advise, but similarly to the car, allow them to take the wheel.

This will improve their confidence in building their wealth, and will also provide a healthy sum to their savings before they leave home, says Harv.

According to Harv, the habit of making debt can be quite impossible to change once you’re used to doing it.

And worse, letting your kid borrow from friends or family will only teach them to rely on loans which will ultimately result in more and more debt for them.

Home is a particularly bad base to form a borrowing habit primarily because, as the parent, you’re more forgiving compared to a business, says Harv.

You might extend their loan period and likely wouldn’t charge interest.

Your children may deduce that making debt is safe but will quake in their boots when they realize the harsh truth - that debt doesn’t buy freedom, it imprisons people.

Even if your due dates are stringent concerning payments or you charge a percentage interest, instead of allowing a bad habit to take hold, Harv suggests that you teach your kids to give debt a wide berth.

Successful money management demands good spending habits.

Don’t feed your children into the trap of instant gratification!

Help them define the difference between wants and needs so they may realize that proactive saving is much more rewarding than paying back later, Harv says.

This major issue must be addressed if you want to encourage financial freedom for your children, Harv says.

And should your kid argue, “But wait, it’s my money. Why can’t I spend it on whatever I want?” do not budge.

Inevitably, poor spending habits will burden your kid with devastating debt or strip them of everything they have, he adds.

The best way to teach them good spending habits according to Harv?

With a budget!

If your kids are going to be making lots of money they must know how to budget.

Harv shares with us how he helped his son cultivate good money-managing habits:

“When my son, Jesse Eker, started at Arizona State, he couldn’t work in the US, so I was still supporting him. BUT that didn’t let him off the hook for tracking his expenses and staying within a budget.

He submitted a budget report to me each semester, I gave him some tips and suggestions, and he would constantly review and update his plan so he could stay on top of his expenses.

So, what did he learn from this? Two main things:

Part of having a budget is keeping track of everything that you buy so you can review your spending and see if you need to make any changes. Jesse learned to keep track of his expenses so he could forecast what he would be spending and decide what was a ‘want’ versus a ‘need.’“

One life-changing habit...

Teach your children how to stay focused as well as how important it is to stay within their means and budget to ensure they grow their net worth successfully while they apply saving, investing & smart spending.

What can you do to encourage them?

First, Harv suggests that you ask them whether they have money to purchase their object of interest.

If they have the money, ask them whether buying said object will prevent them from buying anything else they may need or want more.

So perhaps they really really want it, which is fine, but help them consider it seriously first, cautions Harv.

People often find the finances to pay for things they want, they often also realize that what they bought is not as satisfying as they imagined it might be.

Once they take the time to ponder before they purchase, your kids can determine whether spending their hard-earned dollars on it is really worth it, he adds.

They’re also much more prone to make better decisions and honor their budget.

So teach them how to budget if you’d like them to make lots of money as adults, Harv says.

Of all the influences your kids will have in their lives, Harv emphasizes that you are their first source...

Your kid is ready to actively shape their future financial success when they perceive money to be something they control, instead of something which controls them, says Harv.

Of course, your children will learn through their observation of you, so the most beneficial example you can give them is personally having a positive relationship with your own money.

Help them appreciate that a shortage of money isn’t as much a restriction, but more an opportunity for growth; to take full control of their finances and build an amazing future.

Rich people believe in themselves, and Harv affirms that they also know they’ll succeed.

When you’re determined to be successful, no degree of rock bottom is too far from the stars.

As Harv always says: “Mastering your mind is the most powerful thing you can do to steer yourself down the road to success!”.

And it’s true, as the mind is the faculty we reason with and is programmable!

Help your child find the mindset that all successful multi-millionaires have; it takes effort and commitment to become successful, so be persistent.

And if you’d like to set your kids up for success, encourage them to have a great relationship with their money, insists Harv.

See how you relate...

Would your financial freedom look different from how it looks now?

And how much struggle could you have avoided to arrive where you are now if you’re already financially free?

Applying these principles & tips will not only be of service to your children to ease much of the struggle you endured on your own financial journey but it will just about guarantee they achieve success as adults.

As your children experience minor victories, they’ll become motivated to endeavor for future, major successes, and as we’ve learned, motivation makes a millionaire out of anyone.

So, start now by giving your kids the gift of simple habits & principles to help them pave their way to their own financial freedom.

Personal financial success is primarily a result of repeated deliberate actions.

Your kids learn from the example you set and while you still have influence over them, teach them how to win at life through creating good habits and patterns.

They will learn from you how to be financially successful, how to be financially free, how to save, how to spend, and when.

Give them an opportunity to learn in small ways and once they’ve mastered that, you know they will win in big ways.

Help them understand the different paths involved in being financially free and rich.

Support their ideas on how to make money and guide them towards budgeting, saving, and investing for their future without enabling them as borrowers.

Help them clearly define the difference between a want and a need and hold them accountable for how they manage their mindset and their money.

Do you have a millionaire mindset that you can pass on to your kids?

After all, if they don’t control their future, someone else will.

Your review is like a legacy, so if you liked this post, leave a good star rating, and if not, leave a poor rating - but good or bad, please leave a comment in the ratings, review, and comments section at the bottom of this post and let others know what you think.

Has your Mind ever wondered...

Teach them what you wish you knew sooner - the difference between being financially free and being rich.

Make Personal Finance one of your family’s regular discussion topics and help them get into the habit of managing their money with excellence with the system shown here.

Guide them to have a strong rational decisive mindset, where they own their habits, choices, success, and the consequences of their actions.

Be the example you want them to follow and if you feel you’re not up to the task, find successful influences for them to model so both you and your child can learn from what works best to build wealth.

Encourage your child to earn their income and split their earnings into percentages for their ‘needs’ and ‘wants’, so they can learn to manage what they have responsibly and mindfully.

Show them your investment portfolio and help them select their own investments so they can experience the value of passive income and watch their money grow from young.

Because our habits are informed by our thoughts, raising your child with a wealth mindset is your strongest tool to help them get ahead in life.

Help them nurture their self-discipline when they make decisions around their money, whether during their budgeting practice or their consideration of what to spend their money on.

Guide them on drawing up a budget as per the infographic and allow them to make decisions around their earnings, making sure to specify the difference between their ‘wants’ and ‘needs’.

Don’t lend your kids money as it sends a message that making debt is okay.

What a child needs to achieve success consists of the following:

A good example to follow so they can develop a success mindset.

Opportunities for practical application of a workable budget template.

Encouragement to learn how to generate their own income appropriately and responsibly.

Exposure to learning how to manage their money with decisive mindfulness.

Guidance on appropriate investment in passive income streams.

And of course, knowing how to practice self-discipline wouldn't hurt.

Consider how learning more about the millionaire mindset declarations can empower you to show your child how to develop a millionaire mindset.

This is a very informative article. I was looking more for ways I can invest to set my toddler up to have money when time comes but I will certainly implement these into thier education.