According to Eker's book: Rich people "have their money work hard for them."

Also according to Eker's book: Poor people "work hard for their money."

T. Harv Eker's fifteenth wealth file, "Make Your Money Work For You," revolves around the pivotal concept that true financial freedom and wealth aren't just about earning money, but also about how efficiently that money is employed to generate further income.

Essentially, it's not just about the grind of working for money but flipping the script so that your money is put to work.

From the collective public gaze, this is an age-old principle, often echoed in the timeless adage, "It takes money to make money."

Many resonate with this notion, particularly those acquainted with the ideas of investments, passive income, and compounding interest.

In today's era, where financial independence and early retirement are buzzwords, Eker's emphasis on making money work for you is seen as a foundational pillar.

Within this discourse, tales of successful investors, both from stock markets and real estate, stand as testaments to this principle's potential power.

Stories of individuals who started with modest sums but, through astute investments, transformed them into fortunes highlight the magic of money's multiplicatory power.

However, there's also a side of the public narrative that speaks to the barriers many face in actioning this principle.

For a significant number, the initial hurdle remains accumulating enough savings after managing necessities and debts.

For others, it's the fear and uncertainty tied to the world of investments, often stemming from a lack of knowledge or past experiences with financial setbacks.

Yet, Eker's message is not limited to traditional investments.

In the modern digital age, making your money work might also mean investing in an online venture, backing a promising startup, or even funding one's education to acquire a high-demand skill set.

The public recognizes and appreciates this broad application, as it underscores the principle's versatility.

The overarching narrative Eker presents is clear: financial growth isn't merely a factor of hard work but also smart work.

Many in the public domain recognize this, even if they're at varying stages of implementing it.

Eker's wealth file serves as a nudge for some and a confirmation for others, cementing the idea that wealth generation isn't a linear process of earning and spending, but rather a cycle where money, when used wisely, can perpetually regenerate and grow.

Why not share your insights and perspective by leaving your own personal rating, review and commentary on this wealth file?

T. Harv Eker's fifteenth wealth file delves into the principle that individuals should not merely earn money but should channel those earnings into avenues that generate additional income or growth.

By advocating for passive income and smart investments, Eker suggests that the wealthy don't just work for money—they make money work for them.

The public's response to this tenet has been multifaceted, ranging from spirited endorsement to pointed critique, interspersed with more balanced observations.

When you put the secrets of the millionaire mind to task, you position your income wisely and make your money work for you, while you reap the benefits.

If you grew up being told that you “have to work hard for money,” then you’re like most people.

But, there is a great possibility that you didn’t grow up with the conditioning that it was just as important to make your money “work hard for you.”

Yes, working hard is vital, but if you do it alone, working hard will never make you rich.

You must make your money work for you if you are ever to build wealth.

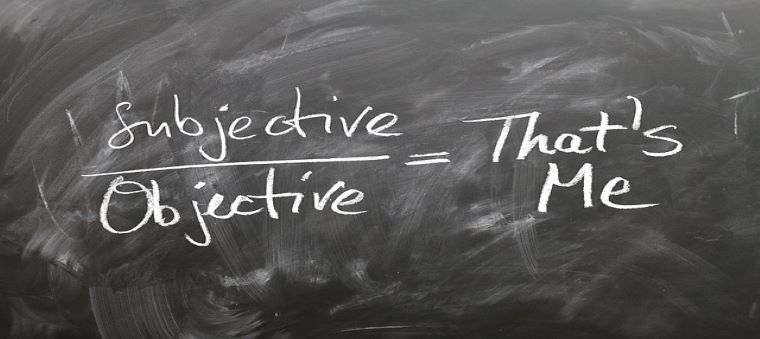

In "Wealth File #15," T. Harv Eker distinguishes between the wealthy and the less affluent through their approach to earning and managing money.

He emphasizes that while the rich make their money work for them, the poor continue to work hard for their money.

Eker's principle challenges the conventional belief that hard work alone leads to wealth, suggesting instead a more strategic approach.

Eker addresses a common upbringing mantra – the need to work hard for money.

He observes that this conditioning rarely includes the equally crucial concept of how to make your money work for you in return.

He argues that hard work, while important, is not a standalone solution for achieving wealth.

This point is illustrated by noting that millions of hardworking individuals globally are not necessarily rich.

In stark contrast, the wealthy, often seen relaxing and enjoying leisure activities, have mastered the art of making their money work for them.

Eker dismantles the myth that hard work is the sole path to riches, citing the old Protestant work ethic of "a dollar's work for a dollar's pay."

He suggests that understanding what the "dollar's pay" is for can shift one's focus from merely working hard to working smart.

This shift enables the wealthy to enjoy their time while their money, business systems, or other people's labor work for them.

According to Eker, while it is true that initially one must work for their money, for the rich, this is a temporary phase.

In contrast, for the less affluent, this becomes a never-ending cycle.

The wealthy understand that initially working hard is necessary to set up a system where money starts working effectively, reducing the need for personal labor over time.

Eker explains that money is a form of energy.

Many exchange their work energy for money energy.

However, those who achieve financial freedom learn to replace their work energy with other forms of energy – like employing others, utilizing business systems, or capital investments.

The aim, as taught in Eker's Millionaire Mind Intensive Seminar, is to reach a point where work becomes a choice, not a necessity – essentially achieving financial freedom.

Eker defines financial freedom as the ability to live your desired lifestyle without the need to work or depend on others for money.

In conclusion, Wealth File #15 from Eker’s perspective is about understanding and applying the concept of financial leverage.

It encourages learning to use money as a tool that works for you, thereby freeing you from the perpetual cycle of working for money.

This file is a call to rethink traditional approaches to work and wealth, advocating for a smarter, more strategic method to achieve financial independence.

Reviewed from the public perspective, here's what is said in praise of this Wealth File:

Eye-Opening Perspective:

Many find Eker's approach refreshing, emphasizing the shift from active income (working for money) to passive income (money working for you).

Long-term Financial Security:

Supporters appreciate the emphasis on investments and other income-generating avenues as strategies for ensuring financial stability and growth in the future.

Relevance in Modern Economy:

With the rise of the gig economy, online investments, and digital entrepreneurship, many see Eker's advice as particularly pertinent in the present context.

Reviewed from the public perspective, here's what is said in criticism of this Wealth File:

Barrier to Entry:

Critics argue that while the idea is sound, not everyone has the initial capital or resources to make their money work for them.

Potential Risk Overshadowed:

Some believe Eker's principle might downplay the inherent risks of investments, which could misguide overenthusiastic beginners.

Overemphasis on Passive Income:

There's a contention that while passive income is beneficial, it shouldn't deter individuals from active engagements or traditional job avenues.

Reviewed from the public perspective, here's what is said in subtle consideration of this Wealth File:

Balanced Approach Needed:

A segment of the public dialogue suggests coupling Eker's advice with risk assessment and financial education to ensure informed investment decisions.

Role of Financial Advisors:

Eker's principle has sparked discussions on the importance of seeking expert advice when looking to invest or generate passive income.

Diversification:

The broader public discourse recommends diversification as a key strategy, underscoring that putting all financial eggs in one basket could be detrimental.

Eker's Wealth File #15 touches on the transformative idea of making money work for individuals, emphasizing passive income and investments.

While many hail the principle for its forward-thinking approach and relevance in today's economy, concerns arise about potential risks and the practicality for all income brackets.

The overarching public sentiment highlights the value of this tenet when paired with financial literacy, expert guidance, and diversification strategies.

Source: Secrets of the Millionaire Mind T. Harv Eker © 2003

Your review is like a legacy, so if you liked this post, leave a good star rating, and if not, leave a poor rating - but good or bad, please leave a comment in the ratings, review, and comments section at the bottom of this post and let others know what you think.

Has your Mind ever wondered...

Manage your money with excellence by getting and staying out of debt & using a budget - splitting your income into percentages between your needs and your wants, building on your emergency fund savings, investment portfolio and passive income streams.

Get and stay out of debt.

Invest in passive income streams and in yourself by constantly learning and growing.

Invest long term in tangible assets, real estate or whichever investment vehicle you’ve thoroughly researched and are passionate about.

When you are financially free, you’re in control of your finances, making decisions based on a sound mindset and taking deliberate action towards building wealth & improving your financial security and stability.

There are no reviews yet. Be the first one to write one.